2020. 2. 8. 22:26ㆍ카테고리 없음

Fundamental Analysis is a broad term that describes the act of trading based purely on global aspects that influence supply and demand of currencies, commodities, and equities. Many traders will use both fundamental and technical methods to determine when and where to place trades, but they also tend to favor one over the other. However, if you would like to use only fundamental analysis, there are a variety of sources to base your opinion. Central Banks Central banks are likely one of the most volatile sources for fundamental trading.

- Technical Vs Fundamental Analysis Forex Metatrader 4 For Mac Pro

- Technical Vs Fundamental Analysis Forex Metatrader 4 For Mac

- Technical Vs Fundamental Analysis Forex Metatrader 4 For Mac Mac

The list of actions they can take is vast; they can raise interest rates, lower them (even into negative territory), keep them the same, suggest their stance will change soon, introduce non-traditional policies, intervene for themselves or others, or even revalue their currency. Fundamental analysis of central banks is often a process of poring through statements and speeches by central bankers along with attempting to think like them to predict their next move. Economic Releases Trading economic releases can be a very tenuous and unpredictable challenge. Many of the greatest minds at the major investment banks around the world have a difficult time predicting exactly what an economic release will ultimately end up being.

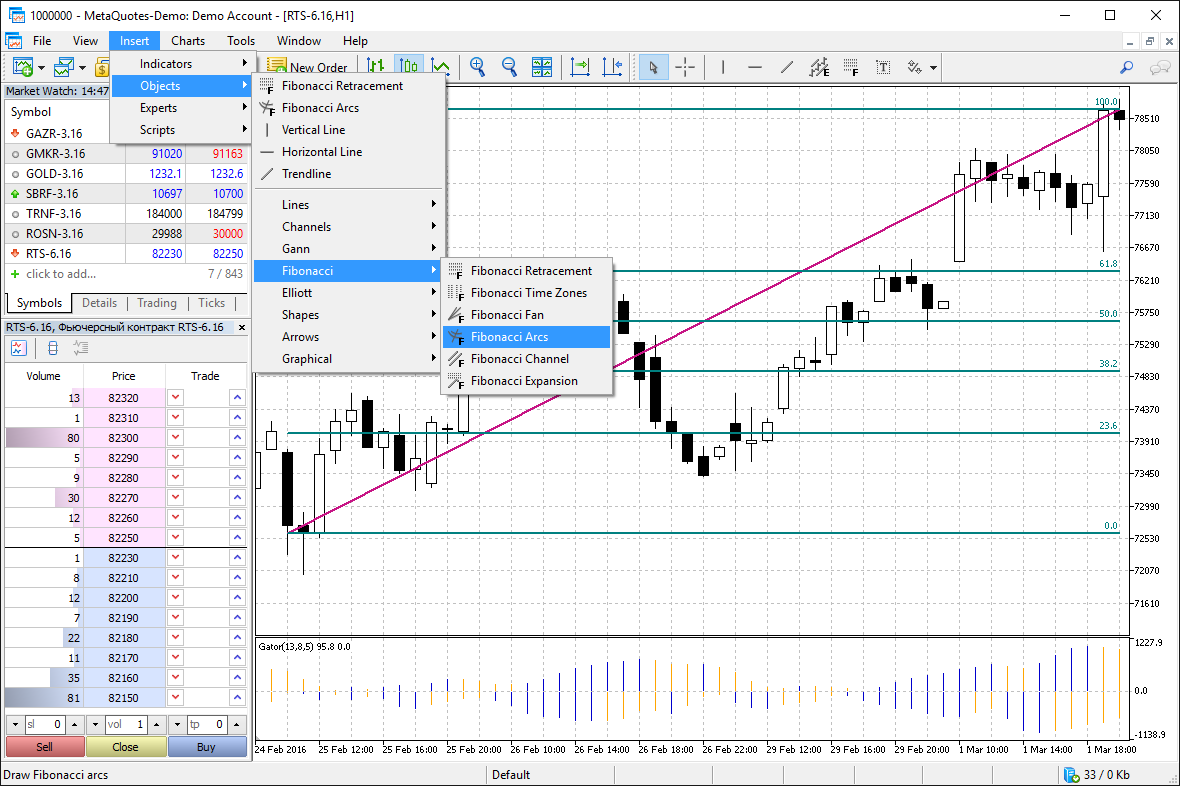

MetaTrader 4 technical analysis tools comprise of 30 built-in indicators, over 2 000 free custom indicators and 700 paid ones, allowing you to analyze the market of any level of complexity. MetaTrader 4 offers 24 analytical objects: lines, channels, the Gann and Fibonacci tools, shapes and arrows. MT5 — combines simple interface of its predecessor with a number of new features covering the needs of both technical and fundamental traders; a wide range of chart timeframes, indicators and graphical objects for more profound technical analysis.

They have models that take many different aspects into account, but can still be embarrassingly wrong in their predictions; hence the reason that markets move so violently after important economic releases. Many investors tend to go with the “consensus” of those experts, and typically markets will move in the direction of the consensus prediction before the release. If the consensus fails to predict the final result, the market then usually moves in the direction of the actual result – meaning that if it was better than consensus, a positive reaction unfolds and vice versa for a less-than-consensus result. The trick to trading the fundamental aspect of economic releases is to determine when you want to make your commitment. Do you trade before or after the figure is released?

Both have their merits and their detractions. If you trade well before the release, you can try to take advantage of the flow toward the consensus expectation, but other fundamental events around the world can impact the market more than the consensus read. Trading moments before the economic release means that you have an opinion on whether the actual release will be better or worse than the consensus, but you could be dreadfully wrong and risk large losses on essentially a coin flip. Trading moments after the economic release means that you will be trying to establish a position in a low-volume market which presents the challenge of getting your desired price.

Geopolitical Tensions Like it or not, some countries around the world don’t get along very nicely with each other or the global community and conflicts or wars are sometimes imminent. These tensions or conflicts can have an adverse impact on tradable goods by changing the supply or even the demand for certain products. For instance, increased conflict in the Middle East can put a strain on the supply of oil which then makes the price increase. Conversely, a relative calm in that part of the world can decrease the price of oil as supply isn’t threatened. Being able to properly predict how these events will conclude may be a way to get ahead of the market with your fundamental perspective. Weather There are a variety of weather-related events that can cause prices to fluctuate.

The easiest example is the propensity for winter to create massive snow storms that can drive up the cost of natural gas, which is used to heat homes. However, there are a variety of other weather situations that can change the value of tradable goods such as hurricanes, droughts, floods, and even tornados. While some of these events are very unpredictable, sometimes it can help to break out the old Farmer’s Almanac or pay close attention to the Weather Channel to see how weather patterns might unfold. Seasonality The seasonality as related to weather is something that makes sense as the natural gas example pointed out above, but there are other seasonal factors that aren’t related to weather as well.

For instance, at the end of the calendar year many investors will sell equities that have declined throughout the year in order to claim capital losses on their taxes. Sometimes it may be beneficial to exit positions before the year-end selloff begins. On the other side of that equation, investors typically come back to equities in droves in January, a phenomenon called “The January Effect.” The end of a month can be rather active as well as businesses that sell products in multiple nations look to offset their currency hedges, a practice termed “Month-End Rebalancing.” Some fundamental factors are more long-lasting while others are more immediate, but trading them can be both difficult and rewarding for those who have the intestinal fortitude to trade them. Also, the fundamental factors listed above are just the start to a list that is much longer in length as new fundamental methods of trading are created every day. So keep your eyes open for new situations that arise and maybe you could be fundamentally ahead of the curve!

Check out the additional educational material we offer to help you achieve your goals.

Difference Between Fundamental Analysis And Technical Analysis How To Read The Chert On Metatrader 4 Double bottom is the inverse of double top. The Differences Charts vs. This smoothing of data makes Moving Averages a popular tool to identify price trends and trend reversals. Traders, usually for their short-term trading decisions, use Technical Analysis very often. Application This indicator is better to use together with a trend indicator most frequently Moving Average: MetaTrader 5 The next-gen.

The durable goods orders report gives a measurement of how much people are spending on longer-term purchases, these are defined as products that are expected to last more than three years. Types Of Analysis Used In ForexForex analysis is used by the retail forex day trader to determine whether to buy or sell The aim of a trader is to purchase an asset in order to later re-sell it a greater price, thus making a profit from the difference. The objective of a technical analysis is to predict future price movements. Once a trading plan is developed through technical analysis and charting skills, trader should then trade and follow the plan.

The highest possible rating assigned to the bonds of an issuer by credit rating agencies. MACD fluctuates above and below the zero line which is also known as the centerline. Once price breaks out, it is the right time to enter as it has much potency to go on in the direction it breaks. The divergence between the two is shown as a histogram or bar graph.

Here are some of the easily seen chart patterns. We'll introduce you to the most important concepts this approach. The more often the price had been tested with a level of resistance or support without breaking it, the stronger the area of resistance or support is. This is because interest rates are a great leveller of the economy. It looks at the historic performance of currencies and uses modern technology to analyze the future behaviour of prices. Price is a leading indicator. It is also one of the most popular formations that been studied thousands of times by analysts.

If the price failed to break through the support or resistance level, a trend reversal will happen soon. Interest rates, perhaps stronger than any other factor, influence currency values. Application In reality, the methods involved in determining values and basing your entire investment strategy on those findings is way more complicated. Capital flows gradually from countries where it accumulates at a potentially slower rate to the countries where it could accumulate at a potentially faster rate. The process of evaluating businesses, projects, budgets and other The general idea is that it takes a knowledge of both supply and demand to make reasonable estimations.

Fundamental analysis aims at assisting in the investment department at a much grander, long-term scale. A double top occurs when prices form two distinct peaks on a chart. There are now hundreds of indicators that any forex trader can use today. If prices were always random, it would be extremely difficult to make money using technical analysis. Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education. Subscribe to our daily market report - powered by Autochartist. Get Free Newsletters Newsletters.

The core premise of fundamental analysis in Forex, as well as other financial markets, is that the price of an asset may differ from its value. Forex trading involves substantial risk of loss and is not suitable for all investors.

The Differences Charts vs. Therefore, each moving average has its own characteristics. Indicators And Oscillators Technical Analysis: Futures, options, and spot currency trading have large potential rewards, but also large potential risk. Table Of Contents 1: Trade balance is a measure of the difference between imports and exports of tangible goods and services. Who uses Technical Analysis?

The levels which hold the most weight are usually the middle levels Dictionary Term Of The Day. We always give our best to provide you with the most accurate and updated knowledge of Forex trading and more materials will be added as the time goes. Technical analysts believe that the current price fully reflects all information. Here is how it works.

Technical Vs Fundamental Analysis Forex Metatrader 4 For Mac Pro

Interest rates, inflation and GDP are the three main economic indicators employed by Forex fundamental analysis. Android App MT4 for your Android device. Anyone can guess right and win every once in a while, but without risk management it is virtually impossible to remain profitable over time. A day trader.

If you have a line connecting a serious of open, high or low or close of price over time, this gives you a line chart. It failed to respond in a very low or alternately very high volatility market conditions due to it is inherently a lagging indicator since the MACD is based on moving averages. Anyone guess right and every once in a while, but without risk management it is virtually impossible to remain profitable over time. The fundamental analyst studies various economic indicators which have are important to the economic health of a country and the subsequent effect on its currency. The information on this site is not Difference Between Fundamental Analysis And Technical Analysis How To Read The Chert On Metatrader 4 at residents of the United States and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. For example, value investors assume that the market is mispricing a security over the short-term, but that the price of the stock will correct itself over the long run. This short-term trading may be further divided into day trading and short-term investment.

Fundamental analysis is the study of the economic conditions underlying a particular currency. Common Forex trading mistakes and traps. So what are chart patterns?

These indicators are found in news reports and news outlets. You see, even after the news is released we can still use technical analysis to trade the price movement, so really technical analysis is the clearest, most practical, and most useful way to analyze and trade the markets. When a support or resistance level breaks, a large trend is taking place and held overtime depending on how strong the broken support or resistance had been holding. Interest rates are the main driver in Forex markets; all of the above mentioned economic indicators are closely watched by the Federal Open Market Committee in order to gauge the overall health of the economy. Companies will pursue backward integration when it As a result, successful trading is not about being right or wrong: Currently, there are hundreds of common technical indicators available in the market.

Retail Sales Index The Retail Sales Index measures goods sold within the retail industry, from large chains to smaller local stores, it takes a sampling of a set of retail stores across the country. I again quote stockcharts on this answer. To avoid central banks can also increase interest rates, thus cutting borrowing rates and leaving less money for banks, businesses and individuals to play around with. This is an important point that I want to make which many fundamental analysts seem to ignore. Here are some of the easily seen chart patterns: Don't trade with money you can't afford to lose. They are specific repeated price patterns that are formed as a result of price action on the charts. In addition, it is a lot easier to make decisions and pinpoint entry and exit signals based on the past behavior patterns of traders.

Technical Vs Fundamental Analysis Forex Metatrader 4 For Mac

Whenever you hear the phrase 'interest rates', people are usually referring to the aforementioned concept. Then, the shape of triangle formed.

The Psychology of Forex Trading. In reality, a line chart is would be rarely used in trading as it does not give you a much more fuller detail like the candlestick the bar chart.

Technical Vs Fundamental Analysis Forex Metatrader 4 For Mac Mac

The differences between the three types of moving averages are only at the way that they are calculated and whether they include all the data available or only the data within a selected period in calculation. Fundamental analysis is one of the basic ways to evaluate stocks. For more insight, read Warren Buffett: When you have a group of candlesticks forming over a certain period of time then this forms a candlestick chart: Simple moving average SMA SMA is calculated by summing up the prices over a certain number of periods and then divided by the number of such periods.